(1558 products available)

A notes exchange machine is also known as a cash recycler or currency exchange machine. It is used for the automatic processing of banknotes. It can store, authenticate, and dispense cash. Here are the main types of note exchange machines:

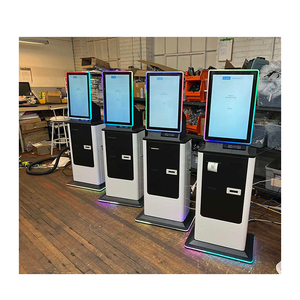

Self-Service Kiosks

Self-service kiosks are public-use machines found in retail stores and banks. They allow users to deposit or withdraw cash without the need for staff assistance. These machines can accept multiple denominations and perform functions like cash deposits, withdrawals, and change dispensing. They are equipped with secure compartments for storing cash and provide an efficient way of handling cash transactions.

Cash Recyclers

These are advanced machines that are used for cash handling in businesses and financial institutions. They can be used to process large volumes of cash. They have the ability to store, deposit, dispense, and exchange banknotes. They are also integrated into ATMs and used to minimize cash logistics burdens in organizations.

Automated Teller Machines (ATMs)

ATMs are specialized machines that are used to dispense cash to customers. Some advanced models can accept cash deposits and perform exchange functions. They are widely used in financial institutions and located in public areas to provide cash access to users.

Cash Management Systems

These are systems that offer comprehensive solutions for managing cash operations in businesses. They can be used in retail chains, casinos, and banks to monitor cash flow, track inventory, and reduce losses. They incorporate various machines such as cash recyclers and self-service kiosks to optimize cash handling processes.

Point of Sale (POS) Systems

POS systems are not note exchange machines per se, but they are sometimes integrated with cash handling components in certain retail environments. They are used to facilitate transactions and manage sales activities. When integrated with cash handling components, they can offer basic functions of cash recycling and change dispensing.

Currency Exchange Machines

These machines are commonly found in airports and tourist areas. They specialize in converting one currency to another and may accept various denominations of banknotes. They are designed to cater to travelers and tourists looking for convenient ways to exchange currency.

Businesses operating in various industries requiring cash transactions can use bill exchange machines. Here are some industries that commonly use them:

When selecting a note exchange machine, various factors demand consideration to ensure the chosen machine meets the intended requirements and offers efficiency, accuracy, and security. Here are the key factors to consider.

Note exchange machines are crucial for businesses, especially for banks and retail outlets that deal with cash transactions. These gadgets have different features and designs based on their roles, functions, and the security level they offer.

Most of these machines have multiple cassettes to enhance their functionality. The cassettes are of great importance, as they help to save time when refilling and ease the machine's maintenance. In addition, the machines can have sensors that detect counterfeit notes. The sensors use infrared light to check for security features in the note and ensure that the currency is genuine.

Some machines also offer the option of sorting notes. Sorting note exchange machines classify notes based on their quality, which helps customers get crisp, unwrinkled notes. The machines can also be designed to recycle notes. This means that if the customer inserts the note into the machine and it is deemed acceptable, it can be returned to the dispenser to be used by the next customer.

As for the design, most of them are rectangular and compact to fit in various locations, such as ATMs and bank teller desks. Some may have LCD screens to provide information on the transaction and elaborate on the machine's operation. Other designs can have connected network systems to ensure that the cash levels and note quality can be monitored remotely.

The primary function of the note exchange machine is to enhance accuracy and efficiency in cash transactions. The machine can provide various denominations, including small and large bills. In addition, the machines can offer secure transactions, which are vital for businesses that regularly carry out cash transactions. This reduces the risks of theft or counterfeit notes, which can be a security threat to many businesses.

Q1: What is the difference between a banknote exchange machine and a banknote recycler?

A1: A banknote exchange machine accepts coins and provides banknotes in exchange, while a banknote recycler is more advanced. It can accept and verify banknotes and dispense new ones by recycling the accepted ones.

Q2: How does a banknote exchange machine ensure the security of transactions?

A2: The machine uses anti-counterfeit technologies like infrared scanning, ultraviolet light detection, and magnetic ink recognition to detect fake notes. It also has physical security features and surveillance to deter tampering and theft.

Q3: Where are banknote exchange machines commonly used?

A3: They are typically used in areas with a high density of people, such as shopping malls, airports, entertainment centers, tourist attractions, hotels, casinos, and public transportation systems.

Q4: Can banknote exchange machines accept foreign currency?

A4: Some models are designed to accept and exchange multiple types of currencies, including foreign ones. However, the capacity largely depends on the machine's specifications and the operator's settings.

Q5: How do banknote exchange machines handle jammed notes?

A5: Most machines have a built-in mechanism to detect jammed notes quickly. They provide error messages to users and automatic self-cleaning and unjamming cycles to resolve the issue. In some cases, manual intervention is required to fix the problem.